That information is useful when you want to borrow cash to expand your small business, to market your corporation to traders, and may make main enterprise selections.. Keep In Mind that the steadiness sheet is sort of a snapshot of a company’s monetary position at a particular time. It displays previous transactions and events, which is great for looking again, nevertheless it doesn’t capture the dynamic adjustments taking place in real-time or present insight into future prospects. Stability sheets are invaluable when evaluating funding opportunities. By examining a company’s stability sheet, we can assess its belongings, similar to properties, tools, and stock, and decide their value and potential for generating returns.

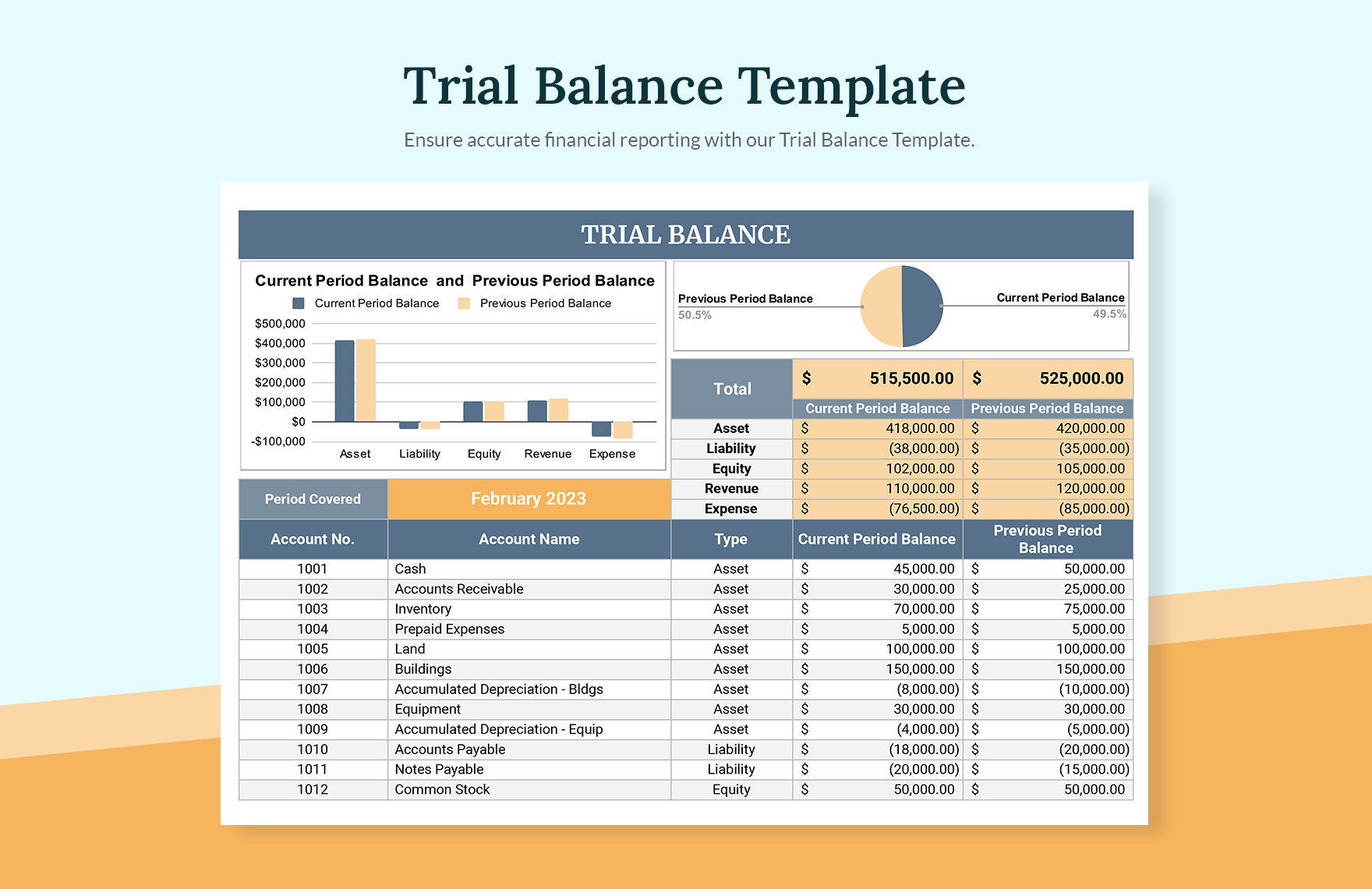

Solvency ratios, such as the debt-to-equity ratio, consider a company’s long-term financial stability. The debt-to-equity ratio is calculated by dividing whole https://www.simple-accounting.org/ liabilities by shareholders’ equity. Profitability ratios, corresponding to return on fairness (ROE), measure a company’s capability to generate revenue from shareholders’ investments.

Parts Of A Stability Sheet

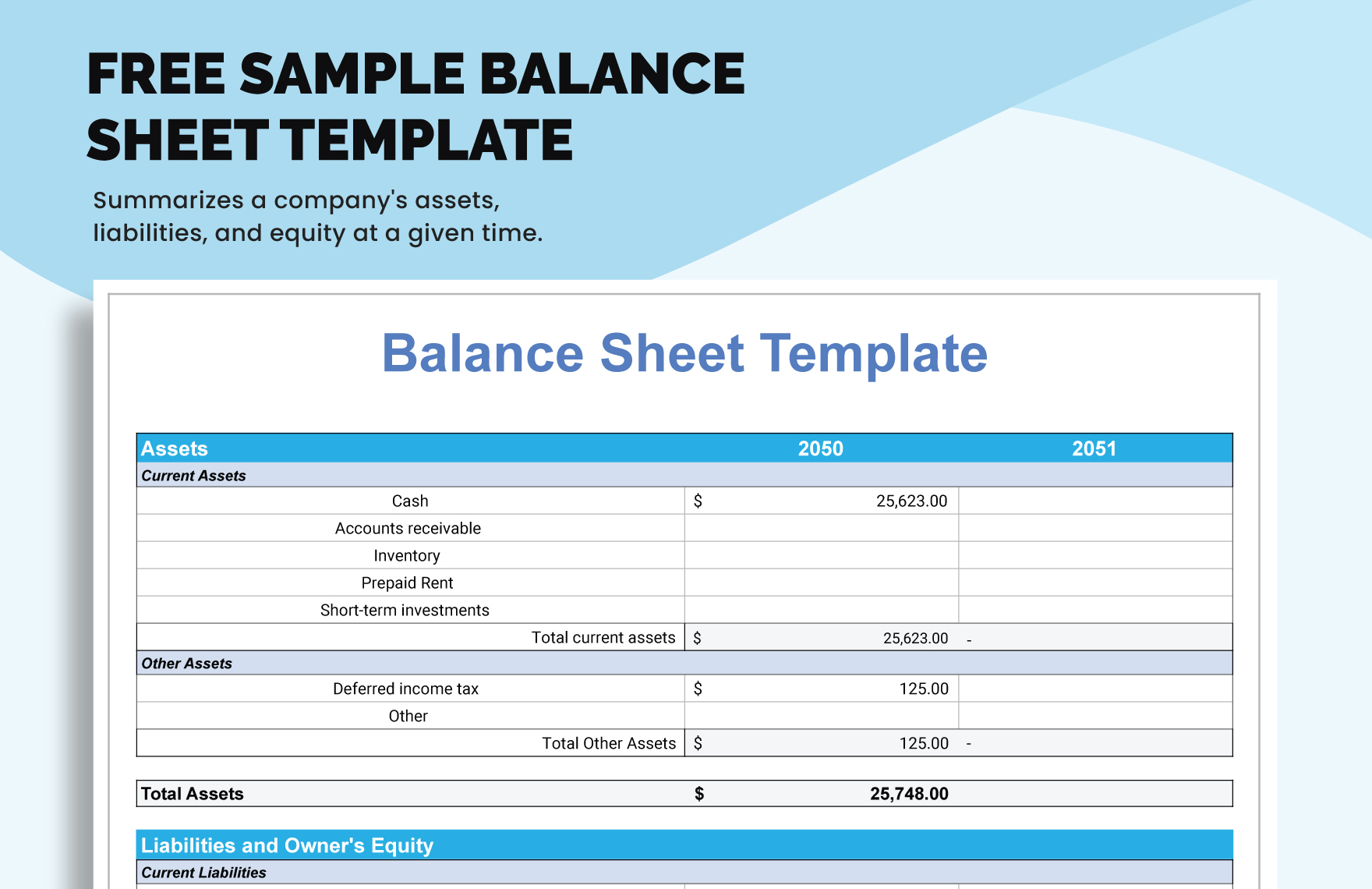

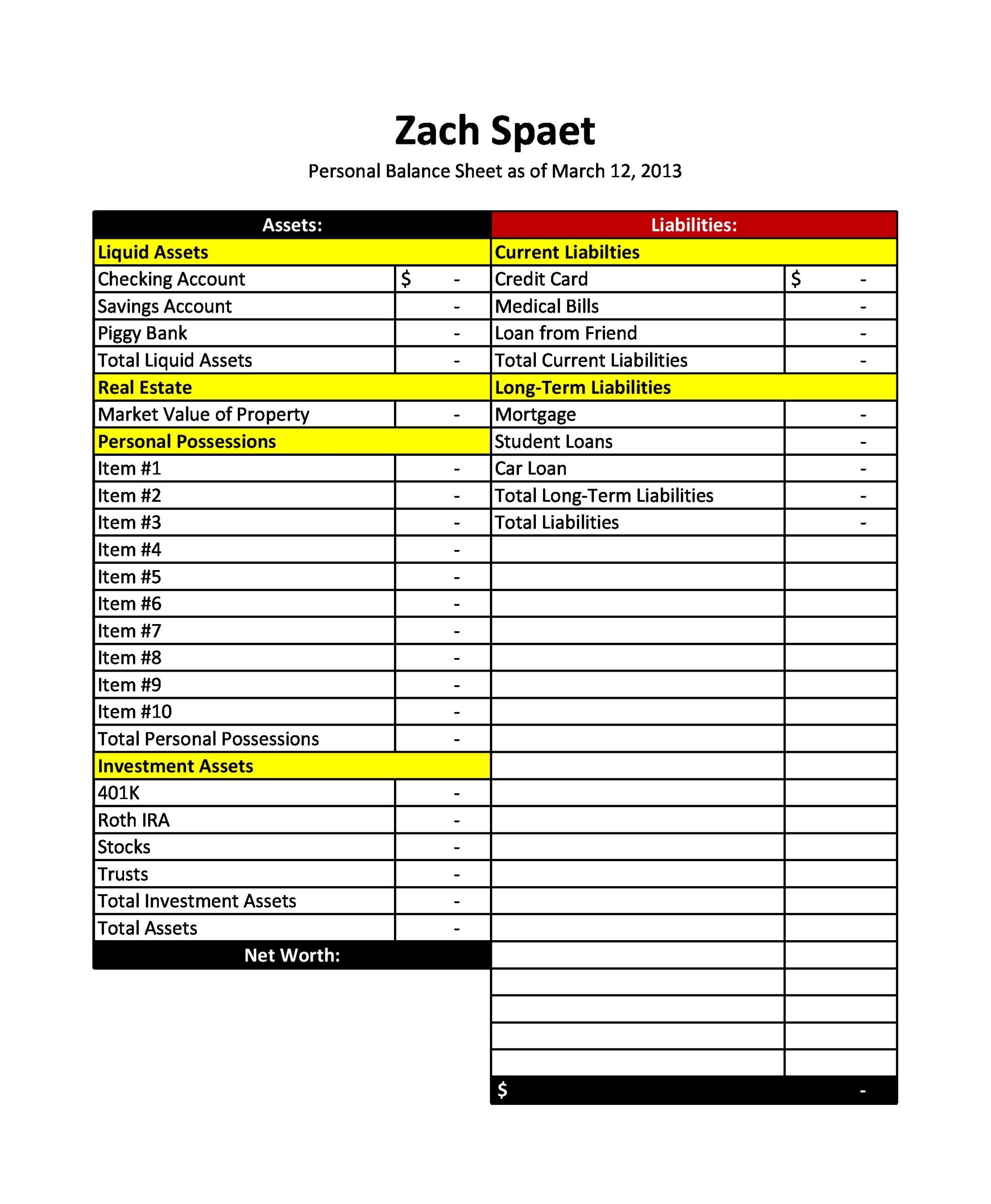

The stability sheet is certainly one of the three core monetary statements that publicly traded corporations release every quarter. Here’s an instance that will help you perceive the information to include on your steadiness sheet. In the instance under, we see that the balance sheet shows belongings (such as money and accounts receivable), liabilities (such as accounts payable, credit cards, and taxes payable), and fairness. Total liabilities and equity are additionally added up at the backside of the sheet—hence the time period ‘bottom line’ for this number. For buyers, a strong stability sheet signifies potential for progress and profitability.

When a banker analyzes your company’s steadiness sheet, he or she calculates specific ratios to determine whether your small business will be able to repay the mortgage. Stability sheets can be utilized to investigate capital construction, which is a combination of your business’ debt and equity. Lenders will issue them into their choices when doing threat administration for credit score. These reports are also used to disclose the monetary position and integrity of your corporation (i.e., the general value of your company), which is significant for attracting traders. Lastly, these statements are legally required to be produced and filed by public companies.

Accountingtools

The most liquid of all assets, cash, appears on the primary line of the steadiness sheet. Firms will typically disclose what equivalents it contains in the footnotes to the steadiness sheet. Accounts inside this segment are listed from prime to bottom so as of their liquidity. They are divided into present assets, which can be converted to cash in a single 12 months or less, and non-current or long-term assets, which cannot. That’s as a end result of an organization has to pay for all of the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from traders (issuing shareholder equity).

- These can include funds similar to long-term mortgages, bonds payable and capital leases.

- On nearer inspection, these varieties work with steadiness sheet software program to gauge total financial performance.

- While it offers priceless insights, it is not the solely real indicator of financial well being.

- Present liabilities are listed first within the liabilities part of the balance sheet as a result of they have to be paid the soonest and require essentially the most instant consideration from the corporate.

Sole props and partnerships could have an owner or partner fairness account on the stability sheet, while corporations with several sorts of shareholders can have several classes. One smart method to method balance sheets is through comparative analysis. This means evaluating a company’s present balance sheet with its past balance sheets or with those of its opponents. For instance, an organization with substantial property and a low debt-to-equity ratio will doubtless be deemed creditworthy, making securing beneficial phrases and interest rates on loans easier.

Steadiness Sheet Parts

These three monetary statements offer a comprehensive snapshot of a company’s operational and financial efficiency during a specified timeframe. Buyers, analysts, and potential collectors leverage these statements to grasp how an organization generates and allocates its funds. For example, if a company’s debt-to-equity ratio is far higher than the business common, it could recommend greater financial risk or reliance on debt. Understanding trade benchmarks provides context and helps you evaluate a company’s monetary place extra successfully.

Shareholder equity is the money attributable to the house owners of a business or its shareholders. It is also called web assets, because it represents the entire property of a company minus its liabilities, or the debt it owes to non-shareholders. Each category consists of several smaller accounts that break down the specifics of an organization’s finances. These accounts range widely by industry, and the same phrases can have completely different implications relying on the nature of the enterprise. Companies would possibly choose to make use of a type of balance sheet known as the common dimension, which exhibits percentages together with the numerical values.

Investing in stock entails risks, together with the lack of principal. Whereas a stability sheet can offer a substantial quantity of information to savvy investors, there are nonetheless some necessary issues to hold in mind. Beneath is a break down of topic weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and enterprise technique. This account includes the amortized amount of any bonds the company has issued.

Some firms problem most popular inventory, which will be listed individually from common stock under this part. Preferred inventory is assigned an arbitrary par value (as is frequent stock, in some cases) that has no bearing on the market worth of the shares. The frequent stock and most popular stock accounts are calculated by multiplying the par worth by the number of shares issued. At this level, the small print and totals in assets vs liabilities have modified – however the equity is similar. Say the corporate makes a $3000 fee – $2000 to the principal of the mortgage and $1000 in interest.